money seeds?

what the heck.

well maybe, could be, right? just do homework and check them out.

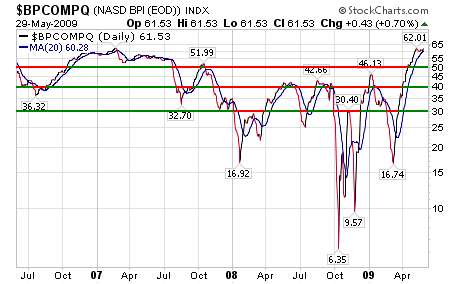

at his point with the market being toppy, tired, but smarter than me and still going higher after i said it was going to pullback i am favoring dividend payors. market is saying, buy, go long. if you look at these picks, do thorough homework and if you take a long position, immediately set an appropriate stop loss order. in this list the divy payers come first. for the record closing prices are all 05/29/2009.

NGLS

NGLS- Targas Resources - is one holding in my personal portfolio. as all "partnerships" the payout ratio is high, but appropriate. the quick ratio of 2.8 is reassuring. they obtain and process natural gas. gas has been crushed, but lets get real, this home grown energy has got to continue its recent climb back. this stock has absolutley no over-head supply, resistance. i am hoping to see a 50% capital gain and almost 20% dividend over the next year. it's not too late to get this one because gas is recovering slowly and NGLS trades with that news.

(full disclosure, i'm already long NGLS in a big way. that large position is up 15% in price and has paid me a quarterly dividend equal to 5% ! )

CALM

CALM - Cal-Maine Foods - man, i wish that i had bought CALM, but i don't own it. my portfolio is

full so i can't add it now. i can't break my rules because cash dollars are the best. on this one i'm looking for a 30% price gain in the coming months and if you own it now you will see almost 7% dividend. CALM may be the perfect buy, set a relaxed stop, reinvest the 7% dividend and hold long-term stock. it goes up and down in a regular pattern so that your investment will grow nicely from the reinvestments. eggs are a commodity that the world needs like crazy and they are one of the best producers. CALM quick ratio is 1.2 and the debt/equity is 0.41, not bad.

now for some good stocks for capital gains, but not paying a divy.

MTZ

MTZ - Mastec - has moderate over-head supply and resistance in the mid $13's. if the market

doesn't crash again we have reasons to consider this one a strong buy because of potential capital gains from here. they are involved in specialty, heavy construction. as the US recovers MTZ will get their share of business and realize the projected earnings growth.there is some debt as one might expect in their business. the debt/eq ratio of 0.61 is not too heavy. i'm targeting about 70% price appreciation in the next year!

FRPT

FRPT - force protection - has been trending up a bit more than Mr. market. there is really no over-

head resistance. i'm not going to be suprised when this one makes a 50% move over the next year. ZERO debt in a defense contractor! quick ratio of 1.7! i tried to make money owning this before, but it was just not ready for primetime. FRPT has now grown up. Buy and set a stop and let her rip, i mean run.

OPTV

OPTV - open TV - this one is trading right at very mild over-head resistance. if the market does not

pullback this one will breakout for about a 30%+ run. they have zero debt and a quick ratio of 3.2. truly massive earnings expansion is being projected. if you jump on i, set and maintain your stops and let her run for capital gains!

a bit more book keeping, my personal holdings have changed since i posted on 05/25/2009. the present portfolio includes:

50% ETFs that hold USA treasury bonds:

SHY (2/5s)

IEI (1/5)

IEF (1/5)

TLH (1/5)

stop loss orders set for about 20%

two high yield dividend payors ( my selection had nothing to do with sector or industry):

NGLS( 2% position)

PSE( 2% position)

stop loss orders set for about 20%

one "capital gain stock":

LO( 2% position)

stop loss orders set for about 10%

one bottom fish:

PCBC( 1% position)

stop loss orders set for about 10%

one "trader":

YGE( 1% position)

stop loss orders set for about 10%

one S&P 2x ETF, SSO ( 7% position, long)

stop loss orders set for about 10%

Cash USA Dollars( 30% - 35%)

USA Dollar in cash is king!!! !! !

* I'm considering selling LO, maybe a potential buyout candidate, and replacing with CALM or OPTV to hold long term. separately, i see how posting my personal, trading portfolio could require a lot of attention and be time consuming so i will do this very infrequently.

bring the economy back, bring the market back, that's fun trading!