Sunday, October 31, 2010

Sunday, October 3, 2010

Saturday, September 4, 2010

Friday, August 27, 2010

How TimothySexton Did It - How to Bake Chicken | eHow.com

Saturday, August 21, 2010

Sunday, January 24, 2010

shaky market

what an uncertain market.

how, what is one to do if they have money out there?

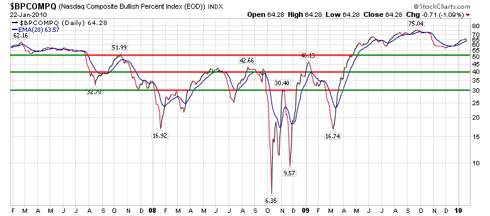

the above chart of the nasdaq % bullish shows that a majority of stocks still have point-n-figure charts( supply and demand charts) that appear bullish. in fact the number of bullish charts remain just above the 20 day moving average of such. so the short-term trend may be turning down, but that process could easily go the other way. so, rely on your trailing stops or if you are a very sophisticated trader buy puts for protection. or if you want to own your companies as a long-term investor just sit tight and hold on.

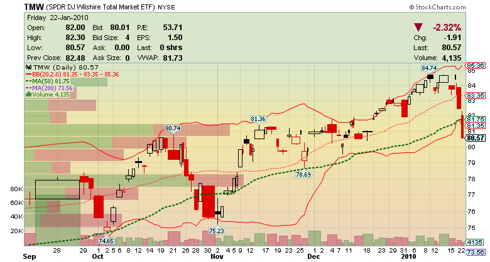

the total market, tmw, has support around 76 or 5% down from here. we've already given up 4% - 5%. so if you are long-term investor, buy some antacid and like i said hold on. who knows if we will turn around before reaching the previous level of support? i will leave my trailing stops where they are. if things go down i will stop out of everything. i'm leaning this way because my screens are finding many more potential shorts than potential longs. that suggest that we may be seeing things rolling over.

but, who knows?

Wednesday, January 20, 2010

update and an interesting find

this could change soon, but for now this chart is telling us that the short-term and intermediate-term trends remain upward as so many charts remain bullish.

we also can see that the etf that tracks the total market has given up a little in the past 4 seesions, but not too much. it says stay long biased for the short and intermediate terms. keep an eye on these two markers and act appropriately when they break down

we also can see that the etf that tracks the total market has given up a little in the past 4 seesions, but not too much. it says stay long biased for the short and intermediate terms. keep an eye on these two markers and act appropriately when they break down

i recently posted about AEA and took a position. i will hold that long. my stock screen for longs has turned up another very interesting stock, PTRY. do homework. this fundamentally sound company is a technical strong buy. this on has already advanced 6% from its low of 2 sessions ago and looks coiled to spring up to another 20% because resistance will be over-come by improving fundamentals

Tuesday, January 19, 2010

Seeking Alpha: new value idea, aea

By fortypercent

first post in a while. i've just been too busy, distracted to post, but i've been very active in the market.aea is ready to move i believe about 2 bucks in the coming few weeks. only issue could be if this market mini-correction grows into something more. i do not think so. i will be taking a position sized to meet my portfolio with an 8% trailing stop loss order. i'm hoping this position will have total return of about 15% within the coming 3 months. check out this chart and go do your homework. lets have some fun trading( get it?) this company has great fundamentals. some of the back-lash about these lenders has calmed down. lately thier best rates are not much different than major credit cards. Disclosure: long aeatest

Sunday, January 17, 2010

we're back with new long, AEA!!